A year after TRID, lenders show signs of growing optimism. The TRID or the Know Before You Owe rules were implemented in October of 2015 and indented to streamline and safeguard consumers in the closing process. Delays and closing times leapt in the wake of the change, but eased to a lower, but elevated plateau.

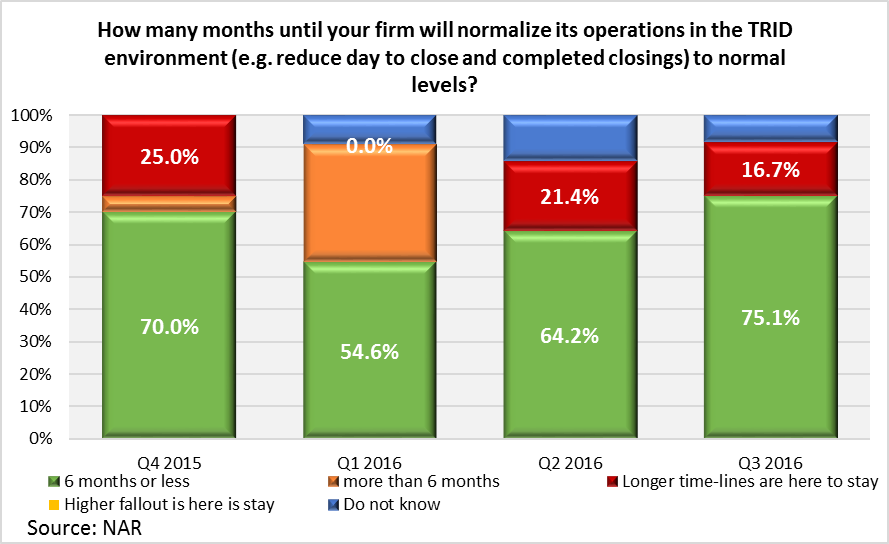

When asked in NAR’s 12th Survey of Mortgage Originators, 75.1 percent of lenders who took part indicated that they would normalize operations in six months or less, the second consecutive gain. However, a significant 16.7 percent indicated that settlement delays were the new norm, a finding that dovetails with continued delays in the settlement process.

The locus of the problem may be with the investors who purchase the mortgages that lenders originate. When lenders were asked about investors’ ability to adapt to the TRID environment, there too was growing optimism, but 25 percent felt that lower demand (e.g. higher rejection and put back rates) from investors because of TRID errors was the new normal. Some argue that improving lenders’ ability to fix TRID errors in loans after origination and before sale to investors might help ease sales to investors. A smooth flow of funds from investors to home buyers is critical for housing.

Powered by WPeMatico